<< Back to Watts Branch main page

The District of Columbia’s floodplain maps in Watts Branch officially changed on October 29, 2024. The new floodplain maps are published through a Letter of Map Revision (LOMR) which is the process to officially update FEMA’s current Flood Insurance Rate Map (FIRM) for the District. The District is made this change to account for better topographic and hydraulic data that was recently made available to the District. The updated official floodplain maps for the Watts Branch more accurately represent the neighborhood’s actual flood risk."

Please use the interactive map below to view the changes. In the map, you can search for your specific address, and view both the old (2010) and new (2024) floodplain maps.

How does the District use Floodplain Maps?

Floodplain maps show three important designated flood zones: the floodway, the 1% annual chance floodplain, and the 0.2% annual chance floodplain. More information on these designated flood zones from FEMA is available here.

The floodway is the channel of the waterway (in this case, the Watt’s Branch tributary) and the land next to it that has the highest chance of flooding. Because the risk is so high in these areas, there are additional restrictions in building codes for development.

The 1% annual chance floodplain is the area surrounding the waterway that has a 1% chance of being flooded in any given year. FEMA also calls this the “100-year flood.” Buildings in these areas must comply with DOEE’s floodplain regulations to protect occupants from flood risk. In addition, most mortgage lenders for homes in the 1% annual chance floodplain require that the owner buy and maintain flood insurance as a condition of financing the home.

The 0.2% annual chance floodplain is the area surrounding the waterway that has a 0.2% chance of being flooded any given year. FEMA also calls this the “500-year flood.” Right now, there are no flood regulations for building in the 0.2% annual chance floodplain, however DOEE is considering updates to its floodplain regulations that if passed, will regulate this area too.

What Changes Happened?

Maps were revised along Watts Branch from a point approximately at Kenilworth Park in the Mayfair neighborhood to a point approximately at the Marvin Gaye Recreation Center in the Grant Park neighborhood.

Overall, the new maps have fewer buildings in the new 1% annual chance and 0.2% annual chance floodplains than there were in the old map. However, at certain locations, buildings that were not in the old floodplain have been added into the new floodplain.

Additionally, the area of the new floodway is significantly larger than the old floodway, so the number of homes within the floodway has increased. Summaries of the LOMR impact on buildings in the District are included below.

|

1% Annual Chance Floodplain |

|

|

Total Buildings in Old 1% Annual Chance Floodplain (FIRM 2010) |

452 |

|

Non-Residential |

69 |

|

Residential |

383 |

|

|

|

|

Total Buildings in New 1% Annual Chance Floodplain (LOMR 2024) |

209 |

|

Non-Residential |

41 |

|

Residential |

166 |

|

Mixed Use |

2 |

|

|

|

|

Buildings Removed from Old Floodplain |

261 |

|

Buildings Added in the New (LOMR) Floodplain |

18 |

|

0.2% Annual Chance Floodplain |

|

|

Total Buildings in Old 0.2% Annual Chance Floodplain (FIRM 2010) |

540 |

|

Non-Residential |

74 |

|

Residential |

464 |

|

Mixed-Use |

2 |

|

Total Buildings in New 0.2% Annual Chance Floodplain (LOMR 2024) |

365 |

|

Non-Residential |

65 |

|

Residential |

298 |

|

Mixed Use |

2 |

|

Buildings Removed from Old Floodplain |

190 |

|

Buildings Added in the New (LOMR) Floodplain |

15 |

|

Floodway |

|

|

Total Buildings in Old Floodway (FIRM 2010) |

5 |

|

Non-Residential |

4 |

|

Residential |

1 |

|

|

|

|

Total Buildings in New Floodway (LOMR 2024) |

77 |

|

Non-Residential |

16 |

|

Residential |

60 |

|

Mixed Use |

1 |

|

|

|

|

Buildings Removed from Old Floodway |

3 |

|

Buildings added in the New (LOMR) Floodway |

75 |

How Do the Changes Impact You?

If your property on the new map is in the same floodplain as the old map, then no changes will occur. If your property is changing floodplains, please see the table below for more information on how it impacts you. Generally, impacts will be in two areas:

Building Requirements: If you are constructing a new home or business in the floodplain, DOEE has regulations to ensure that the new construction is done in a way that reduces flood risk to occupants. Similarly, if you “substantially improve” your home or business, your project must comply with the regulations as well. However, if you aren’t building something new or substantially improving a structure on your property, then you aren’t required to do anything because of the change in floodplain. In other words, simply being mapped in a new floodplain does not mean you have to make changes to your home or business.

Flood Insurance: FEMA’s flood insurance rates are determined by the amount of flood risk to the home as measured by elevation of your property and other factors. Flood insurance rates are not a function of what floodplain you are in, though if your home is within the floodplain or floodway, it likely means it is lower elevation and therefore higher risk, which may result in a higher premium. Most mortgage lenders require their customers to have flood insurance if the home is in a floodway or the 100-year floodplain. No matter what floodplain you are in, even if you are outside all floodplains, you can purchase flood insurance.

|

Where is Your Property? |

||||

|

|

New Map – In Floodway |

New Map – In 100-year Floodplain |

New Map – In 500-year Floodplain |

New Map – Not in any Floodplain |

|

Old Map – In Floodway |

Building Requirements: No change, subject to all building requirements including an encroachment analysis.

Insurance Requirements: No change, insurance still required by mortgage lenders. |

Building Requirements: Still subject to building requirements, but now encroachment analysis no longer required.

Insurance Requirements: No change, insurance still required by mortgage lenders. |

Building Requirements: No longer subject to building requirements but may be subject to requirements if new regulations are passed.

Insurance Requirements: Insurance no longer required by mortgage lenders. |

Building Requirements: No longer subject to building requirements.

Insurance Requirements: Insurance no longer required by mortgage lender. |

|

Old Map – In 100-year Floodplain |

Building Requirements: Still subject to requirements, which will now include an encroachment analysis.

Insurance Requirements: No change, insurance still required by mortgage lenders.

|

Building Requirements: No change, still subject to requirements.

Insurance Requirements: No change, insurance still required by mortgage lenders. |

Building Requirements: No longer subject to building requirements but may be subject to requirements if new regulations are passed.

Insurance Requirements: Insurance no longer required by mortgage lender.

|

Building Requirements: No longer subject to building requirements.

Insurance Requirements: Insurance no longer required by mortgage lender. |

|

Old Map – In 500-year Floodplain |

Building Requirements: Previously no requirements, but now subject to building requirements, including an encroachment analysis.

Insurance Requirements: Previously no insurance requirements. Insurance now required by mortgage lenders. |

Building Requirements: Previously no requirements but now subject to building requirements.

Insurance Requirements: Previously no insurance requirements. Insurance now required by mortgage lenders.

|

Building Requirements: No change, not subject to building requirements but may be subject to requirements if new regulations are passed.

Insurance Requirements: No change, insurance not required. |

Building Requirements: No change, not subject to building requirements.

Insurance Requirements: No change, insurance not required.

|

|

Old Map – Not in any Floodplain |

Building Requirements: Previously no requirements, but now subject to building requirements, including an encroachment analysis.

Insurance Requirements: Previously no insurance requirements. Insurance now required by mortgage lenders. |

Building Requirements: Previously no requirements but now subject to building requirements.

Insurance Requirements: Previously no insurance requirements. Insurance now required by mortgage lenders.

|

Building Requirements: No change, not subject to building requirements but may be subject to requirements if new regulations are passed.

Insurance Requirements: No change, insurance not required.

|

Building Requirements: No change, not subject to building requirements.

Insurance Requirements: No change, insurance not required.

|

A Note About Climate Change

In June 2015, DOEE published the “Climate Projections & Scenario Development, Climate Change Adaptation Plan for the District of Columbia.” The report concluded that the frequency and intensity of extreme precipitation events are expected to increase in future years. Changes in precipitation patterns will add stress to infrastructure and increase the risk of flooding, including in areas such as Watts Branch.

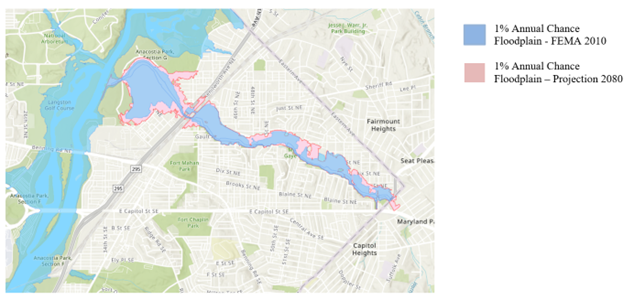

While the new LOMR maps described above incorporate the most recent flood risk data, they do not account for predicted future conditions. Because of the increase in precipitation caused by climate change, floodplains are expected to increase in size as time goes on. The map below shows DOEE’s estimation of the 1% annual chance floodplain projected for the year 2080. This map is not official and will not be used for regulatory purposes, it is being provided only for public awareness.